Missoula Federal Credit Union expands to 20 counties in western, central Montana

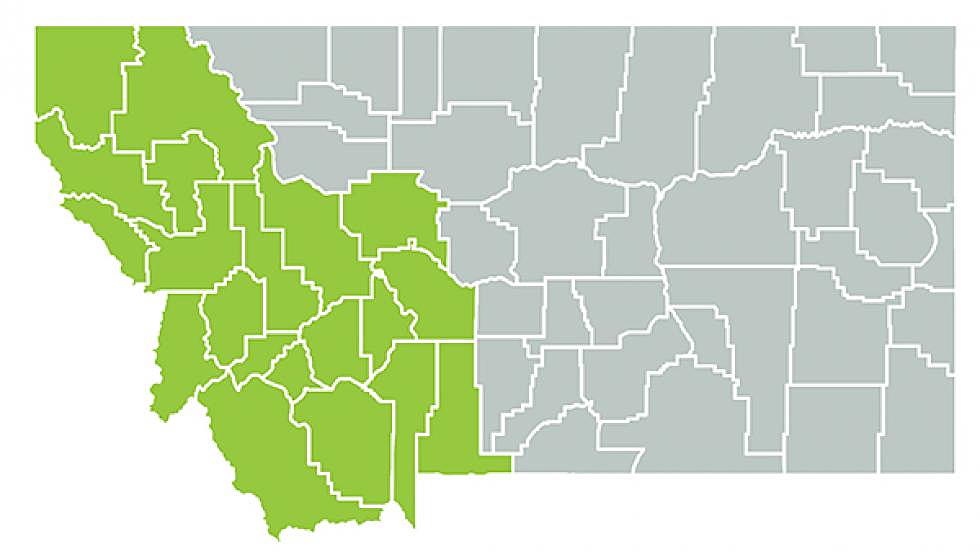

Missoula Federal Credit Union has expanded its membership area from three counties – Missoula, Lake and Ravalli – to 20 contiguous counties in western and central Montana.

The move reflects a national trend toward consolidation and mergers of credit unions, and will help MFCU compete more effectively, said Jack Lawson, the credit union’s president and CEO.

“Most of our competitors enjoy larger markets than does Missoula Federal Credit Union,” he said. “This allows them to take advantage of more opportunities to meet customer and member needs. With this expansion, we too will enjoy these advantages.”

With 55,000 members, MFCU is the state’s second-largest credit union and largest Community Development Financial Institution. Previously, Missoula FCU merged with the University of Montana Credit Union and Northern Pacific Credit Union.

The new geographic expansion opens membership to individuals, businesses and organizations in Beaverhead, Broadwater, Cascade, Deer Lodge, Flathead, Gallatin, Granite, Jefferson, Lake, Lewis and Clark, Lincoln, Madison, Meagher, Mineral, Missoula, Park, Powell, Ravalli, Sanders, and Silver Bow counties.

It is not without challenges, Lawson said, but the credit union’s leadership intends to move forward “thoughtfully and transparently,” and in consultation with its member-owners. That includes a membership survey asking for feedback on the expansion, concerns the move creates for existing members and the possibility of a name change to better reflect the larger geographic area.

“While we are incredibly excited to reach more people with our approach to values-based banking, we also recognize that some important questions lie ahead,” Lawson said in a letter to MFCU members. “In answering them, we want to make sure we’re living out our principles of cooperative ownership, inclusion and empowerment. That starts with hearing from you.”

Missoula Federal Credit Union dates to 1956, when eight Missoula police officers pooled their $320 (famously kept in a shoebox) and promised to “help one another and others in their community.”

In recent years, the credit union has adopted a “values-based banking” approach centered on “cooperative ownership, being inclusive, empowering our staff and our members, and delivering positive social, economic and environmental impacts,” Lawson said. “Not all banks and credit unions share that value system.”

The service-area expansion not only gives MFCU the opportunity to offer its approach to thousands of new potential members, but the larger market will “enable us to continue to build the financial strength of the credit union,” he said.

Since 1970, credit unions nationwide have consolidated rapidly – from 24,000 to 6,000, at last count.

“Despite this national trend, we are thriving,” Lawson said. Missoula FCU manages more than $500 million in community assets.

Credit unions differ from traditional banks.

“We are a locally owned, not-for-profit financial cooperative powered by our volunteer Board of Directors and members,” Lawson said. “Every member owns a share of the credit union and has an equal say in the direction of our organization. The financial success of the credit union is passed along to members.”

In the new 20-county service area, membership will be open to people who live, work, worship and attend school in those counties. It also includes people in associations headquartered in, and people who participate in programs to alleviate poverty or distress which are located in those counties. And it serves incorporated or unincorporated organizations located in, or maintaining a facility in, the service area.