Tax revenue losses nearing $1B in Montana

By David Crisp

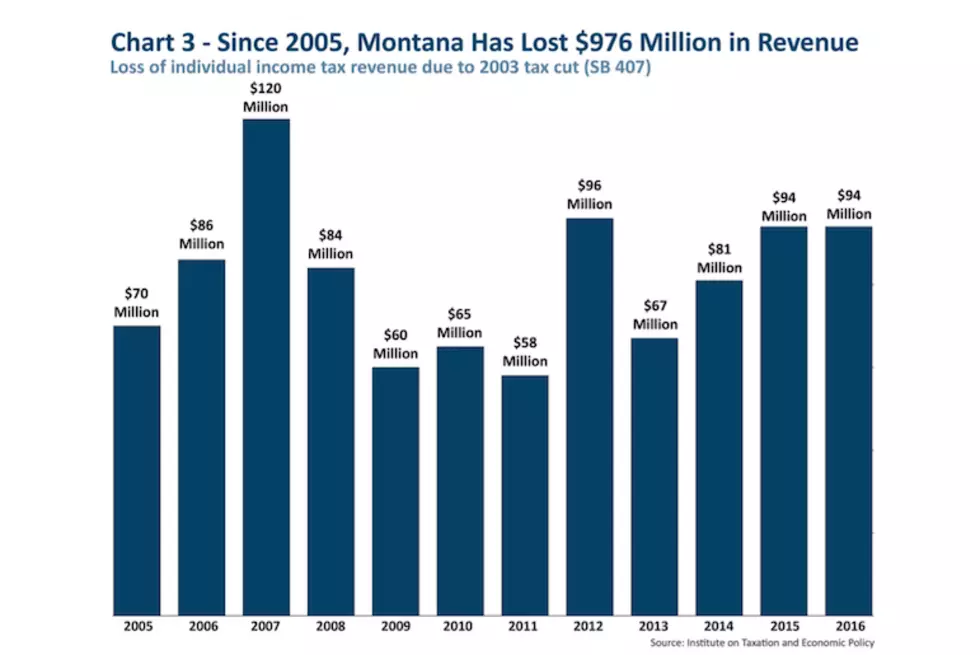

Revenue losses from Montana tax cuts passed in 2003 are approaching $1 billion, a new report says.

“The Montana We Could Be: Tax Cuts, Aimed at the Rich, Take a Toll,” a report by the nonprofit Montana Budget and Policy Center in Helena, estimates that the tax cuts will have cost $976 million by the end of 2016. That’s enough to pay the deferred maintenance costs for all of the school districts in the state, the report says.

The tax cuts, which took effect in 2005, reduced the number of tax brackets from 10 to six and cut the top income tax rate in Montana from 11 percent to 6.9 percent. The legislation also, among other changes, gave a 2 percent tax credit on capital gains.

Overwhelmingly, the tax cuts favored Montana’s wealthiest citizens, the center argues. Someone making just $15,000 a year now pays income taxes at the same rate as someone making $1 million, the center says, and more than 85 percent of Montana taxpayers get no benefit from the capital gains tax credit. As Last Best News has reported, many Montanans got no tax cut at all from the changes, and some 24,000 saw their tax bills go up.

The upshot is that many middle-income families in Montana pay taxes at a higher rate than those with incomes of $500,000 and more, especially those rich people who make their money off investments rather than by working.

Gubernatorial candidate Greg Gianforte has proposed further cutting the top tax rate, from 6.9 percent to 6 percent. He argues that the cuts in 2005, and earlier cuts in the 1990s, led to increased tax revenues.

The center disagrees, but unfortunately the new report doesn’t do much to settle the question. It refers to evidence also cited by Last Best News in our earlier report, noting that the Montana Department of Revenue’s own analysis didn’t find much evidence the tax cuts helped. The report also mentions the Center on Budget and Policy Priorities, which analyzed 15 major studies and found that 11 of them concluded that cutting state income taxes had few economic benefits.

This is just danged hard stuff to figure out. Tax revenues increase for lots of reasons, some of which have nothing to do with government policy. How tax dollars are spent may matter as much as how many tax dollars are collected. It’s especially complicated in Montana, because the 2003 tax bill didn’t just cut taxes, it also raised certain taxes and created others.

Where the center’s report makes its most telling points is in its discussion of education funding at all levels in Montana. It notes that Montana is one of just eight states that has no pre-kindergarten program, as defined by the National Institute for Early Education Research. But the NIEER does point out that Gov. Steve Bullock has made early education a top priority and that the state has taken some steps to improve early education.

For kindergarten through 12th grade, the center points out, state funding has increased 79 percent since 1994. At the same time, property taxes for education have gone up 162 percent, not counting bond levies for school construction.

At the college level, tuition and fees at four-year institutions increased 55 percent from 2013 to 2014, the center says. Nearly two-thirds of college students getting baccalaureate degrees in Montana have student debt averaging more than $26,000.

The center’s solution? A higher top rate, an end to the capital gains tax credit and a state earned income tax credit for working families near the poverty line. Will that plan fly? It might depend on how you vote.

This story originally appeared in Last Best News in Billings.