Gov. Little says most Idahoans should receive special session rebate checks by Thanksgiving

Clark Corbin

(Idaho Capital Sun) Idaho Gov. Brad Little says Idahoans who filed their taxes on time should expect to see special session tax rebate checks by Thanksgiving.

On Friday, Little told the Sun the state has issued 192,000 rebate checks totaling $133 million so far.

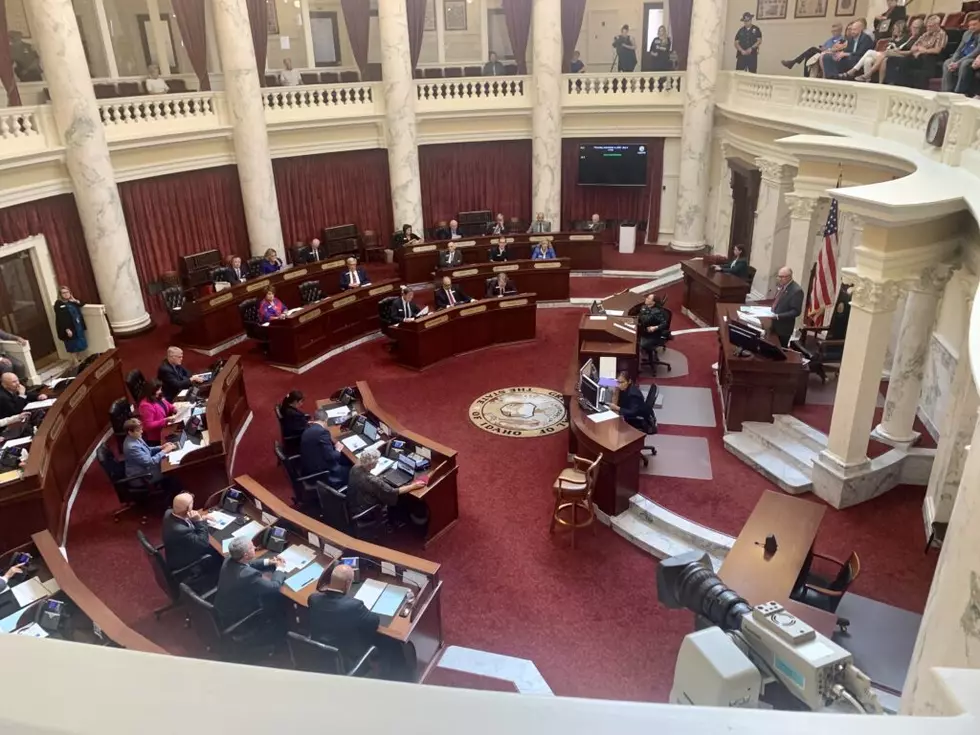

The rebate checks were approved during the Sept. 1 special session of the Idaho Legislature as part of an approximately $1 billion package to reduce the state’s record budget surplus, cut taxes and increase education funding.

“By Thanksgiving, almost everybody that didn’t file late or have a complication or get flagged should be done,” Little said in a telephone interview.

Little said by the end of next week he hopes Idaho State Tax Commission can finish sending out all rebates for everyone who filed tax returns on time and has direct deposit set up for refunds.

“All the direct deposits that don’t have any kind of flag on them should be done next week is my understating,” Little said.

In the days leading up to the Sept. 1 special session, Little and Republican legislative leaders touted how quickly they would be able to send $500 million in tax rebate checks to Idahoans.

Officials with the tax commission have begun processing the rebates and issued the first rebates Sept. 26, Idaho State Tax Commission public information officer Renee Eymann said Thursday.

“Because of system limitations, we’re not able to issue the tax rebates all at once,” Eymann said. “Rebates issued via direct deposit go out first as we can issue about 60,000 of them each day. The rebates we send by paper check are limited to 75,000 per week.”

Although Little hopes most Idahoans without a tax complication will get rebates by Nov. 24, some Idahoans may have to wait several more months. In addition, some Idahoans are also still waiting on a rebate check from an earlier round of tax rebates Little signed off on in February.

“The Tax Commission expects to send about 800,000 rebates totaling up to $500 million by the end of March 2023,” Idaho State Tax Commission officials said in a press release issued Tuesday.

On Friday, Little said the March timeline reflects how long it could take to provide rebate checks to people who filed their taxes late or who have an issue with their taxes.

“Some people that have very complicated tax returns always file late. It’s a way of life for them to pay a penalty,” Little said.

State officials also want to take the time to make sure they aren’t sending out rebates to people who don’t qualify for them, Little added.

The rebates are for a minimum of $300 for individuals and $600 for joint filers.

Gov. Brad Little emphasized speed of tax rebates at August press conference

In an Aug. 23 press conference where he announced he was calling a special session, Little emphasized how quickly the state would be able to get the rebates to Idahoans.

“We’ve done two test runs on (the tax rebate system),” Little said when the Sun asked him for the timeline of issuing rebate checks. “We did 10% (rebates) two years ago, 12% (rebates) this year. It’s based on the 2020 taxes, so we know the number. It’s almost a just push print action compared to anything else that would be more complicated. That’s the beauty, in my mind, of this proposal is how fast we can get it implemented and get that money out.”

At the time, the Sun then asked Little whether Idahoans would have that money in their pockets heading into the holiday season.

“No, no, no,” Little said. “It will be before that.”

KTVB has posted a video of Little’s press conference on YouTube.